Straight line depreciation formula maths

What is straight-line depreciation. Learn how to write a depreciation linear equation given a word problem.

Depreciation Of Car Word Problem Solution Youtube

Example of Straight Line Depreciation Method.

. Straight Line Depreciation is the simplest method of depreciation. Straight Line Method of Depreciation. Need an Easy Accurate Way to Comply with State Depreciation Across Multiple States.

Math and Arithmetic. Ad Expertly Manage the Largest Expenditure on the Balance Sheet with Efficiency Confidence. In the straight line method of calculating depreciation a constant depreciation charge is made every year on the basis of total.

Straight-line depreciation is a type of depreciation method that allows companies to allocate the cost of an asset based on its depreciated value. Straight Line Method is the simplest depreciation method. She has taught math in both elementary.

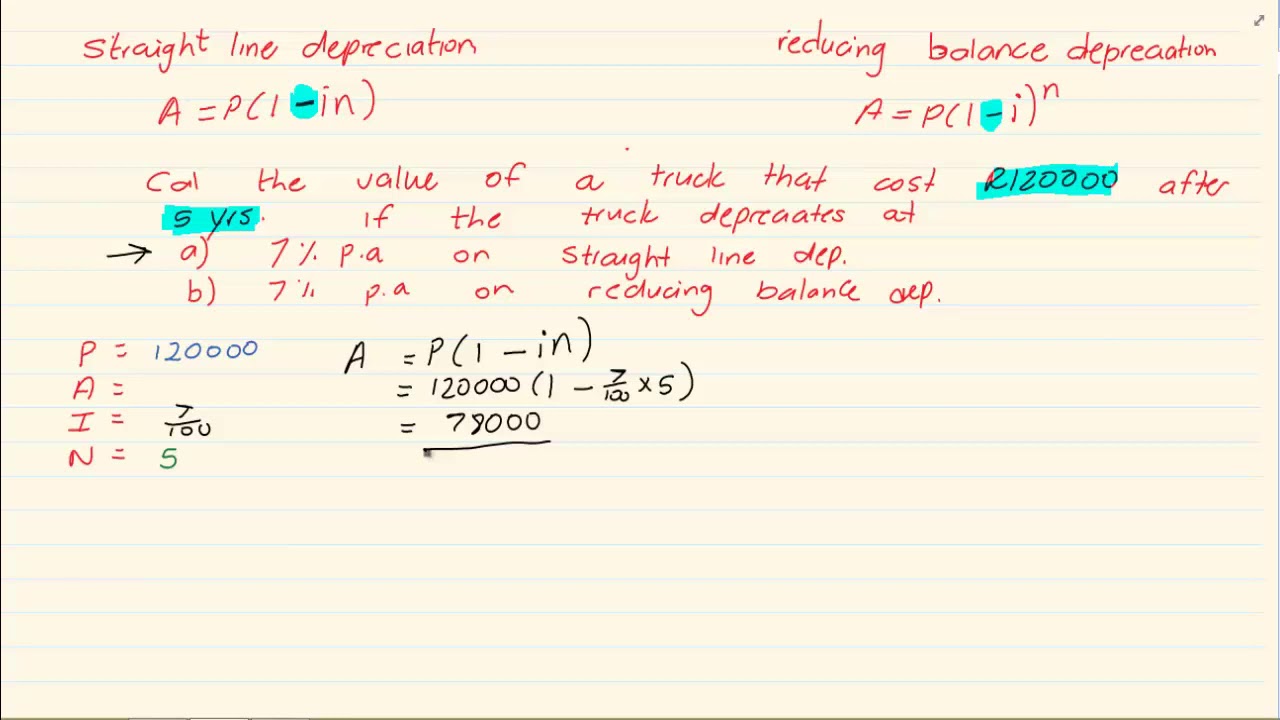

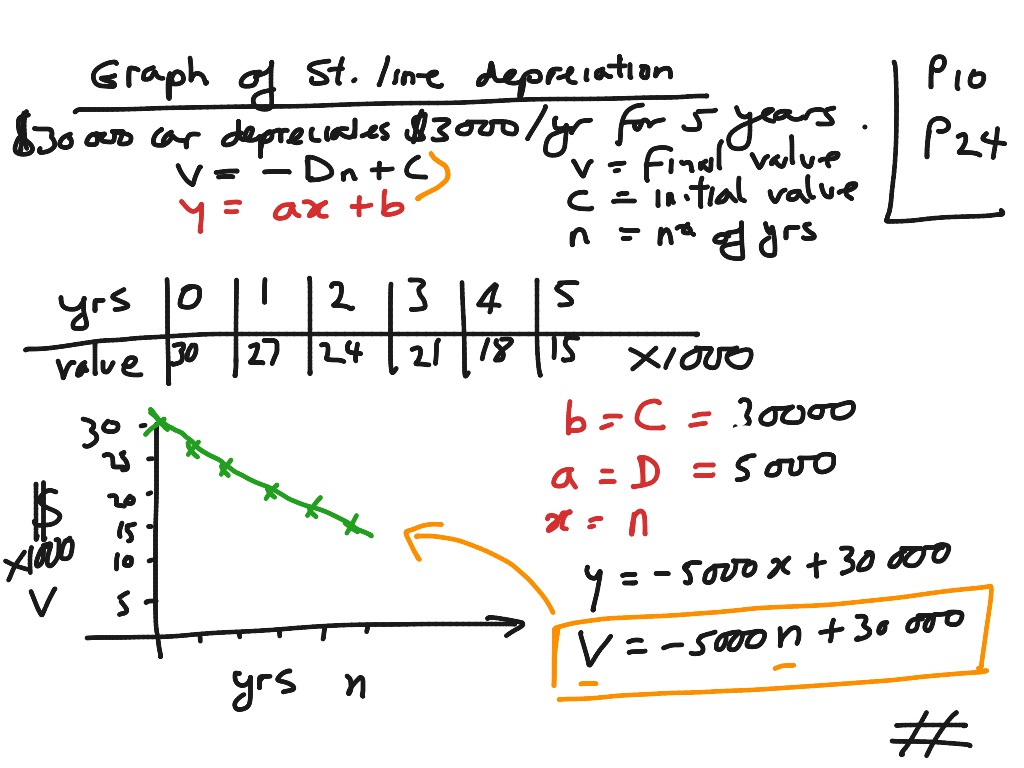

Straight-line depreciation occurs when the value of the item decreases by the same amount each period. Straight-line depreciation is a method used to calculate the decline in value of fixed assets such as vehicles or office equipment. The salvage value of asset 1 is 5000 and of asset 2 is.

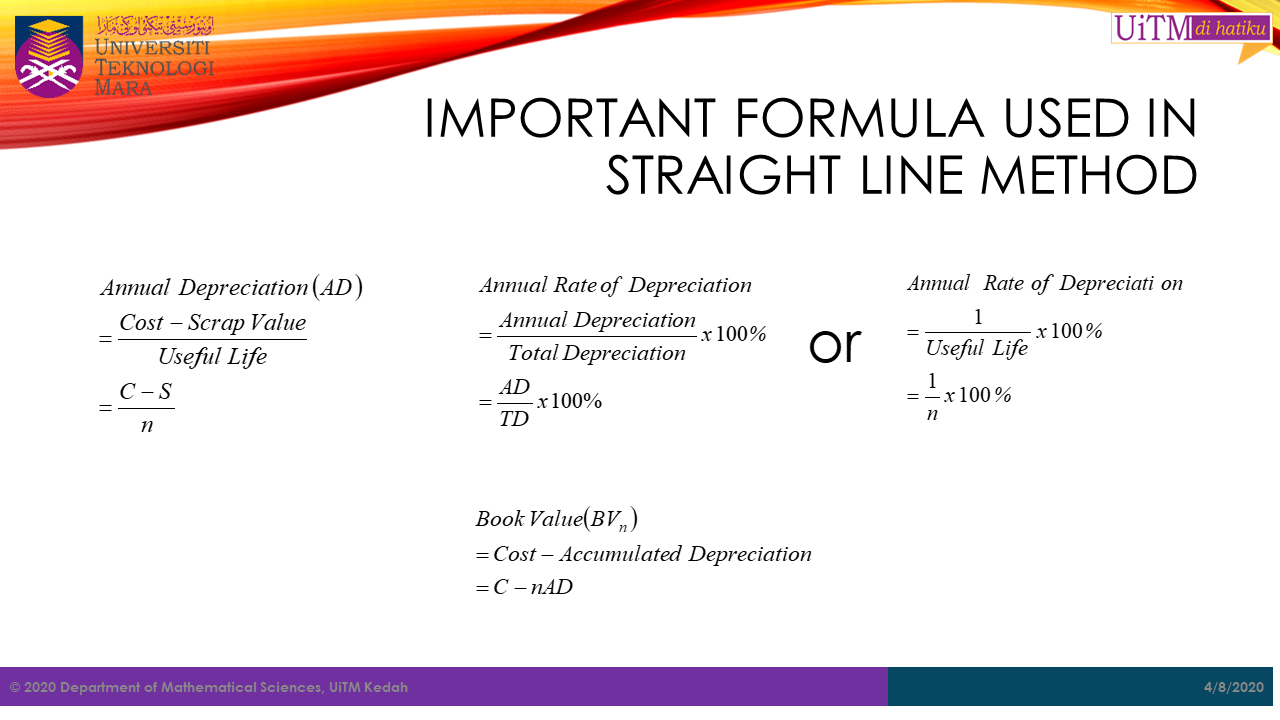

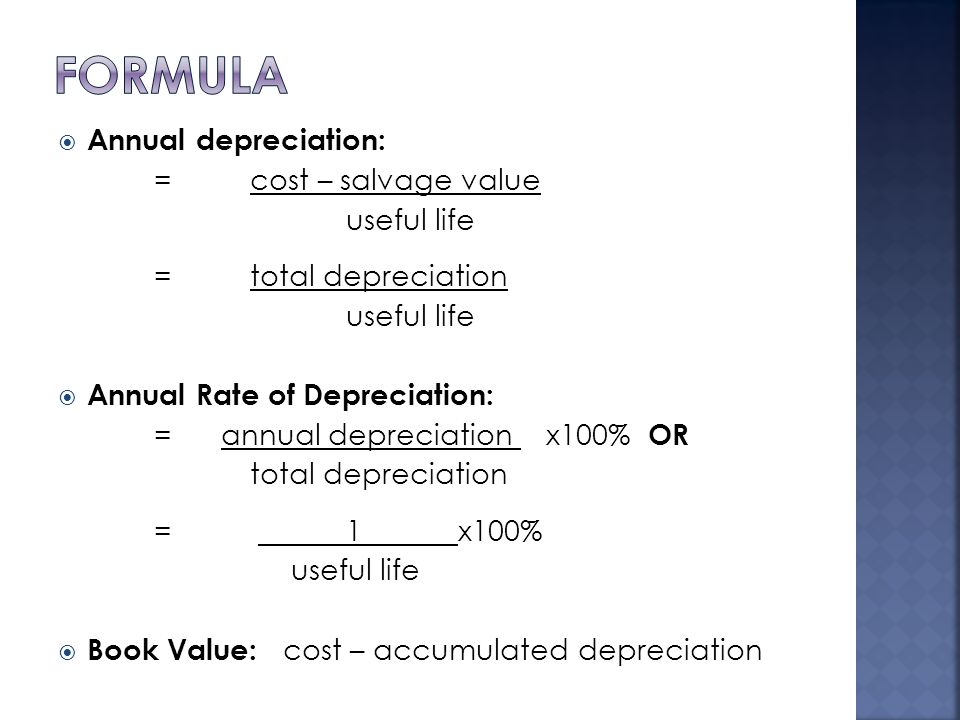

Annual Depreciation Expense Asset Price - Residual Value Useful life of the asset. Need an Easy Accurate Way to Comply with State Depreciation Across Multiple States. This type of calculation is often.

Ad Expertly Manage the Largest Expenditure on the Balance Sheet with Efficiency Confidence. The simplest and most commonly used straight line depreciation is calculated by taking the purchase or acquisition price of an asset subtracted by the salvage value divided by the total. We discuss the slope intercept form of a line to write the straight line depreciatio.

Has purchased 2 assets costing 500000 and 700000. Worksheets are Depreciation A01 depreciation overview eng final Prepared by el hoss igcse accounting. Formula for Straight Line Depreciation.

Straight Line Method SLM According to the Straight line method the cost of the asset is written off equally during its useful life. This post will help explain the formula involved in. Formula for calculating straight line depreciation.

For minimizing the tax. It assumes that a constant amount is depreciated each year over the useful life of the property. Business Accounting and Bookkeeping.

The Depreciable Value is equally split across the useful lifetime of the asset. Therefore an equal amount of depreciation is charged every. Displaying all worksheets related to - Depreciation Straight Line Method.

Double Declining Balance Depreciation. Straight Line Basis. A straight line basis is a method of computing depreciation and amortization by dividing the difference between an assets cost and its expected salvage.

1 Free Straight Line Depreciation Calculator Embroker

Ex Model Depreciation Using A Linear Function Determine Slope Youtube

How To Calculate Depreciation Straight Line Method Depreciation Youtube

Annual Depreciation Of A New Car Find The Future Value Youtube

What Is The Straight Line Depreciation Formula How To Calculate Straight Line Depreciation Video Lesson Transcript Study Com

Math Sc Uitm Kedah Depreciation

Depreciation Formula Calculate Depreciation Expense

Straight Line Depreciation Youtube

Gt10103 Business Mathematics Ppt Download

9 2 Simple And Compound Depreciation Finance Growth And Decay Siyavula

Method To Get Straight Line Depreciation Formula Bench Accounting

What Is The Straight Line Depreciation Formula How To Calculate Straight Line Depreciation Video Lesson Transcript Study Com

Grade 11 Financial Maths Depreciation Youtube

1 Press Ctrl A C G Dear 2009 Not To Be Sold Free To Use Straight Line Depreciation Stage 6 Year 12 General Mathematics Hsc Ppt Download

Straight Line Depreciation Graph Math Finance Flat Rate Depreciation Economics Showme

Find A Formula For A Function Modeling Linear Depreciation Solve A Linear Equation Youtube

2